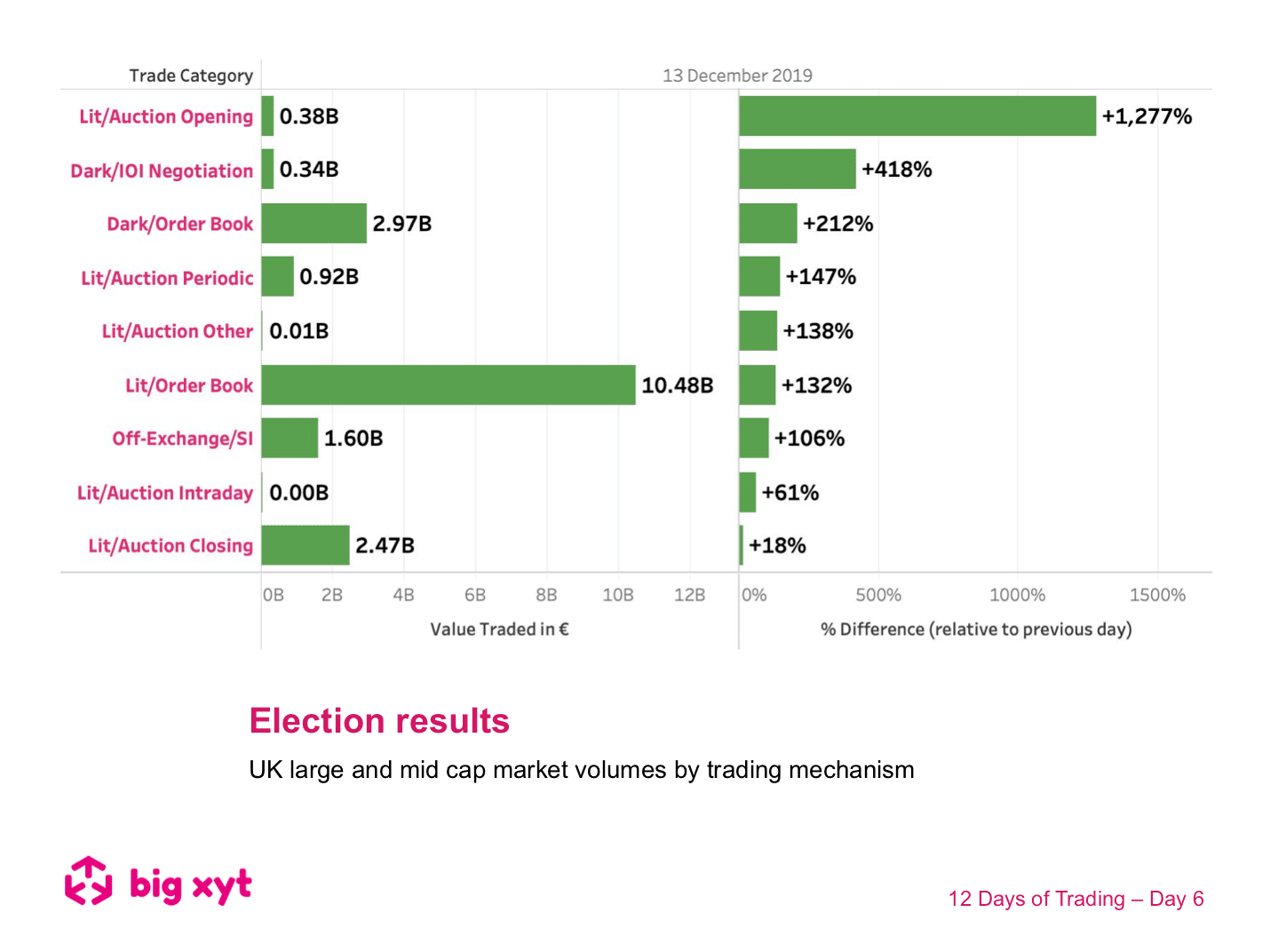

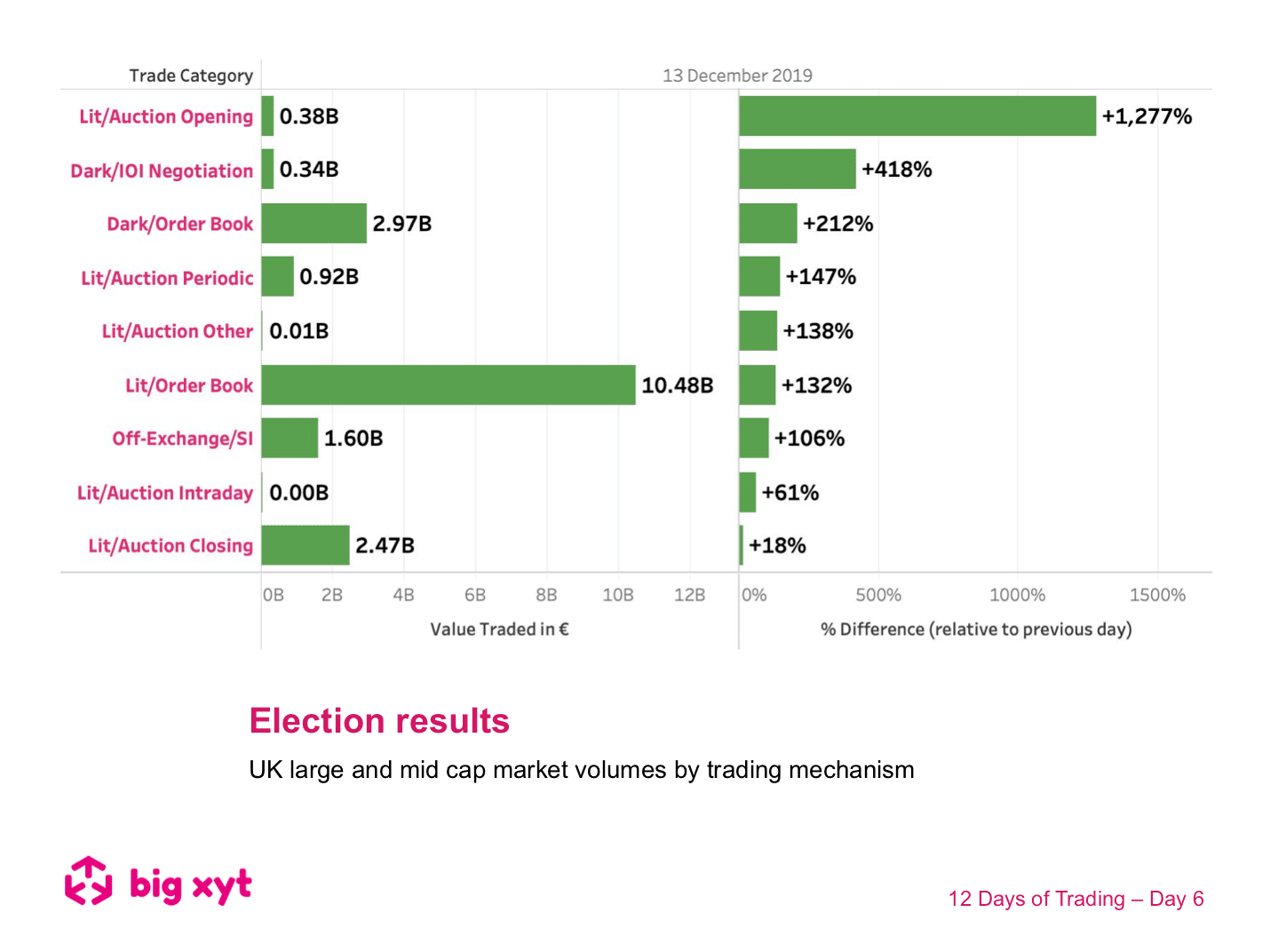

12 Days of Trading – Day 6 of 12: Election Results

16 December 2019

/

big xyt

/

Views

Related Insights