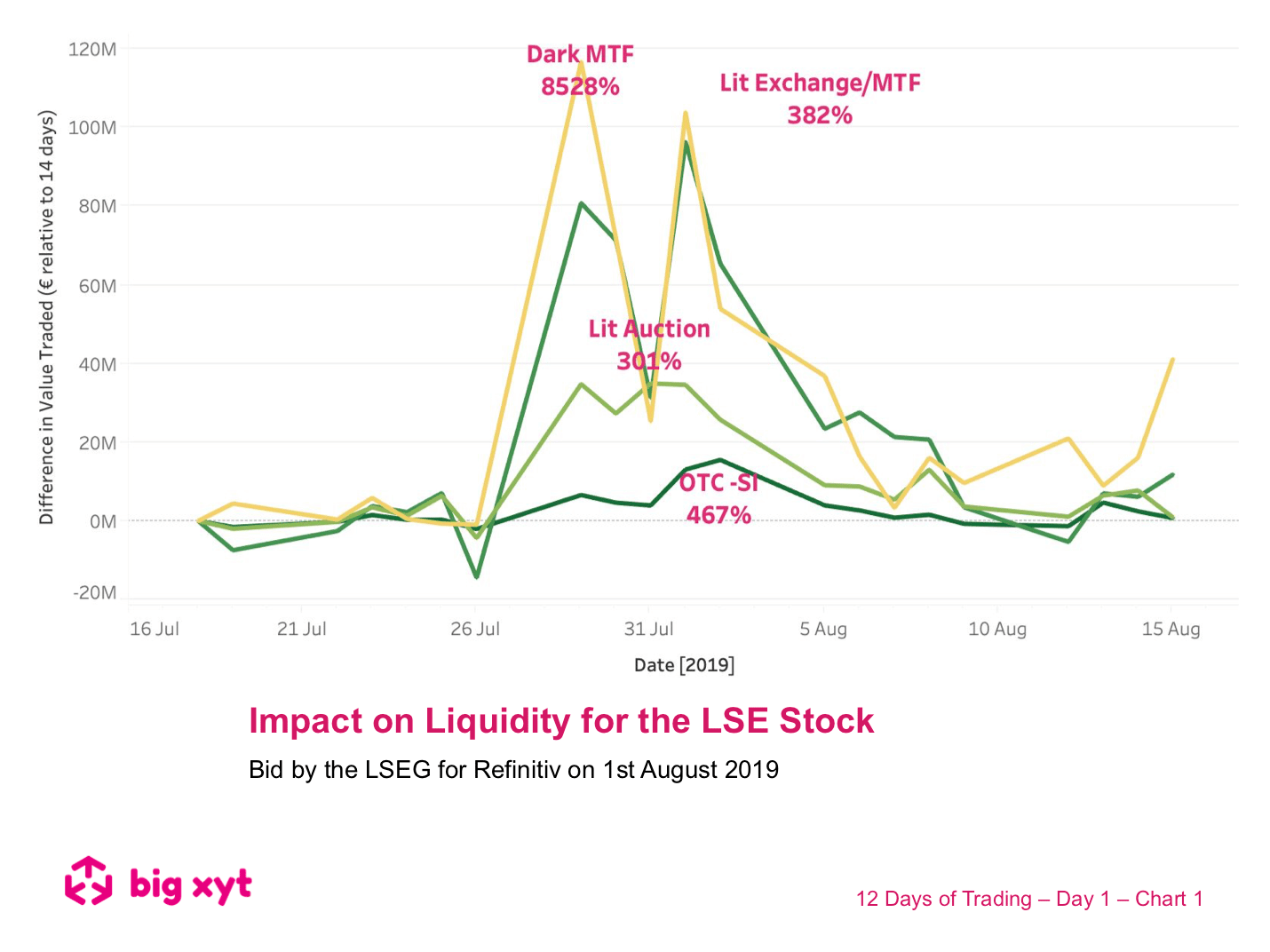

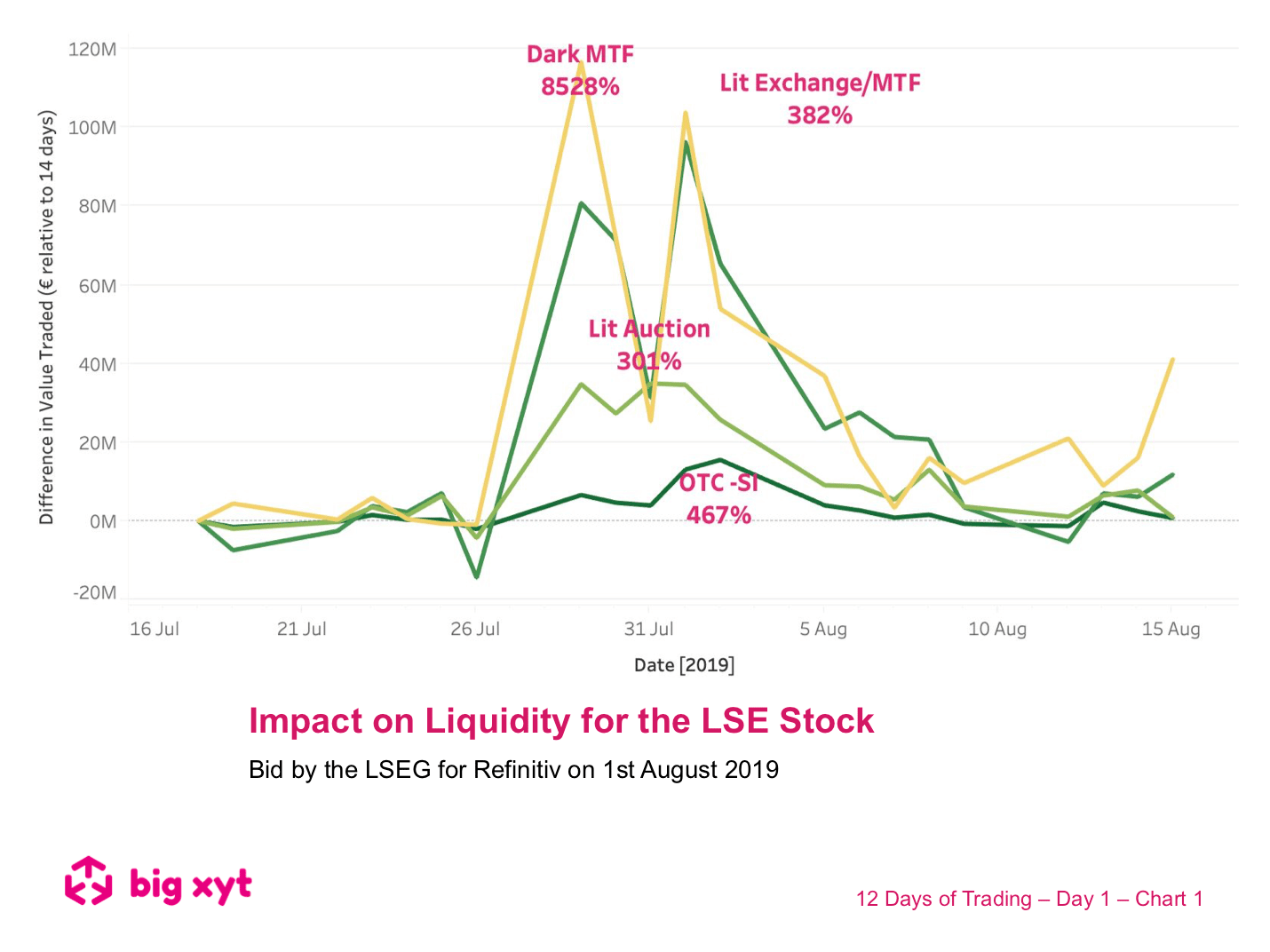

12 Days of Trading – Day 1 of 12: Impact on Liquidity for the LSE Stock

09 December 2019

/

big xyt

/

Views

Related Insights