xyt

Microsoft Outperforms Meta - Or Maybe Not!

Microsoft and Meta reported Q2 results on the 28th. Both beat consensus expectations on revenue and earnings, with Microsoft marginally outperforming estimates on both measures. Yet the market reaction diverged sharply: MSFT fell more than 12%, while META rose around 10%.

The difference lay not in reported results, but in forward-looking narratives. Both companies framed their outlooks around AI investment, but investors appeared more comfortable with Meta’s path to monetisation, while Microsoft’s elevated capex and margin trajectory unsettled sentiment.

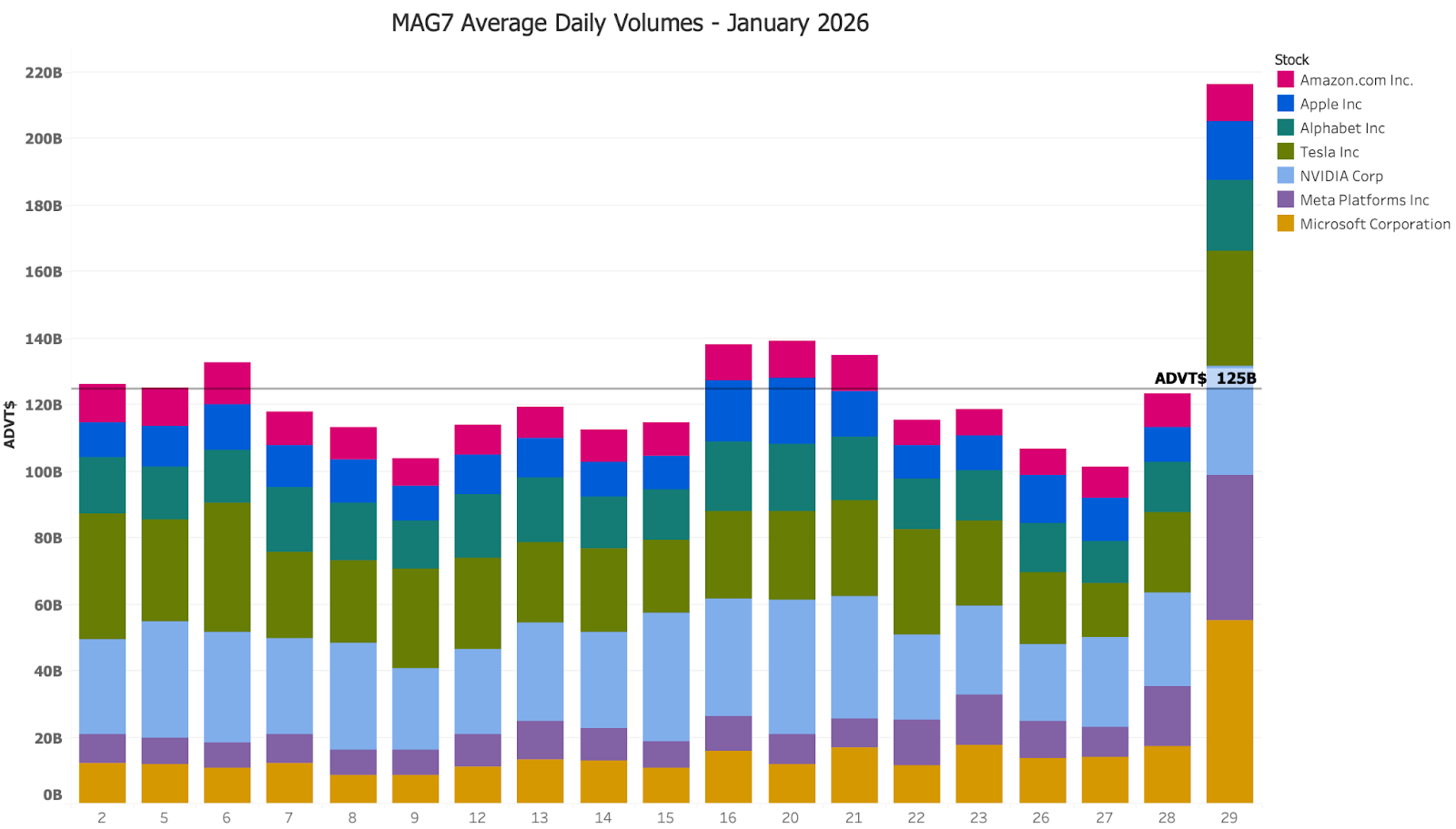

Why does Liquidity Matters care? Because this episode is a textbook example of how liquidity acts to amplify investor sentiment (a “sentimegaphone?”) — a mechanism that takes subtle shifts in investor perception and amplifies them into visible, measurable market action in real time. During the event, Microsoft shares turned over approximately $55bn in value, around five times the 2025 daily average.

The episode shows other considerations over the MAG7. The scale of liquidity available among these names means there must be a very significant and rapid change in investor sentiment to drive such instantaneous action to move the price so quickly. It shows it is not just one investor but many. In the case of MSFT the compounding effects of de-leveraging and margin calls may have contributed to the rush for the door. We note that this occurred against a backdrop of stress in the JPY/USD carry environment (JGB long dated yields spiked earlier in the week and a period of US dollar weakening). With the VIX spiking higher this morning, it’s a sign of how jumpy the market is getting, especially around AI, and a reminder of the potential for overconcentration and systemic risk in these names. Fortunately the META results came with a calming effect as a counterbalance to MSFT.

Watching liquidity tells us as much about behaviour as price. We know that the MSFT price tumbled, but the trading flows tell us about the how, where and how fast it tumbled. As we showed in Episode One of Liquidity Matters, analysing flows by timing, types of liquidity pool and both recent and historical trends helps to unpack the underlying story. Crucially, it helps us to understand execution quality, in this case during an extreme event when ADV based algorithms have to work hard to adjust their volume curves and volume participation rates, and when indicators have to cope with rare outlier levels of volatility. Stress events must be incorporated into models for backtesting and optimisation, and this is where Liquidity Matters.

Read Liquidity Matters to learn more how liquidity, volatility and price creation are inextricably linked.